Sometimes less is more when it comes to day trading. Devoting two to three hours a day is often better for most traders of stocks, stock index futures, and index-based exchange-traded funds (ETFs) than buying and selling stocks the entire day.

Specific hours provide the greatest opportunity for day trading, so trading only during these hours can help maximize your efficiency. Trading all day takes up more time than is necessary for very little additional reward. In many cases, even professional day traders tend to lose money outside of these ideal trading hours.

Key Takeaways

- Some hours offer the best opportunities to buy and sell stocks, so it makes sense to focus on them rather than risk losing money at other hours.

- The first two and last two hours tend to be the best times to trade the stock market—the beginning and the end of the day.

- The first and last hours of the day are usually the most volatile as well, so they can be the best for more experienced traders.

- Historical trends can give insight into what markets might do again week-to-week, month-to-month, or year-to-year, but they’re never guaranteed.

Best Times to Day Trade the Stock Market

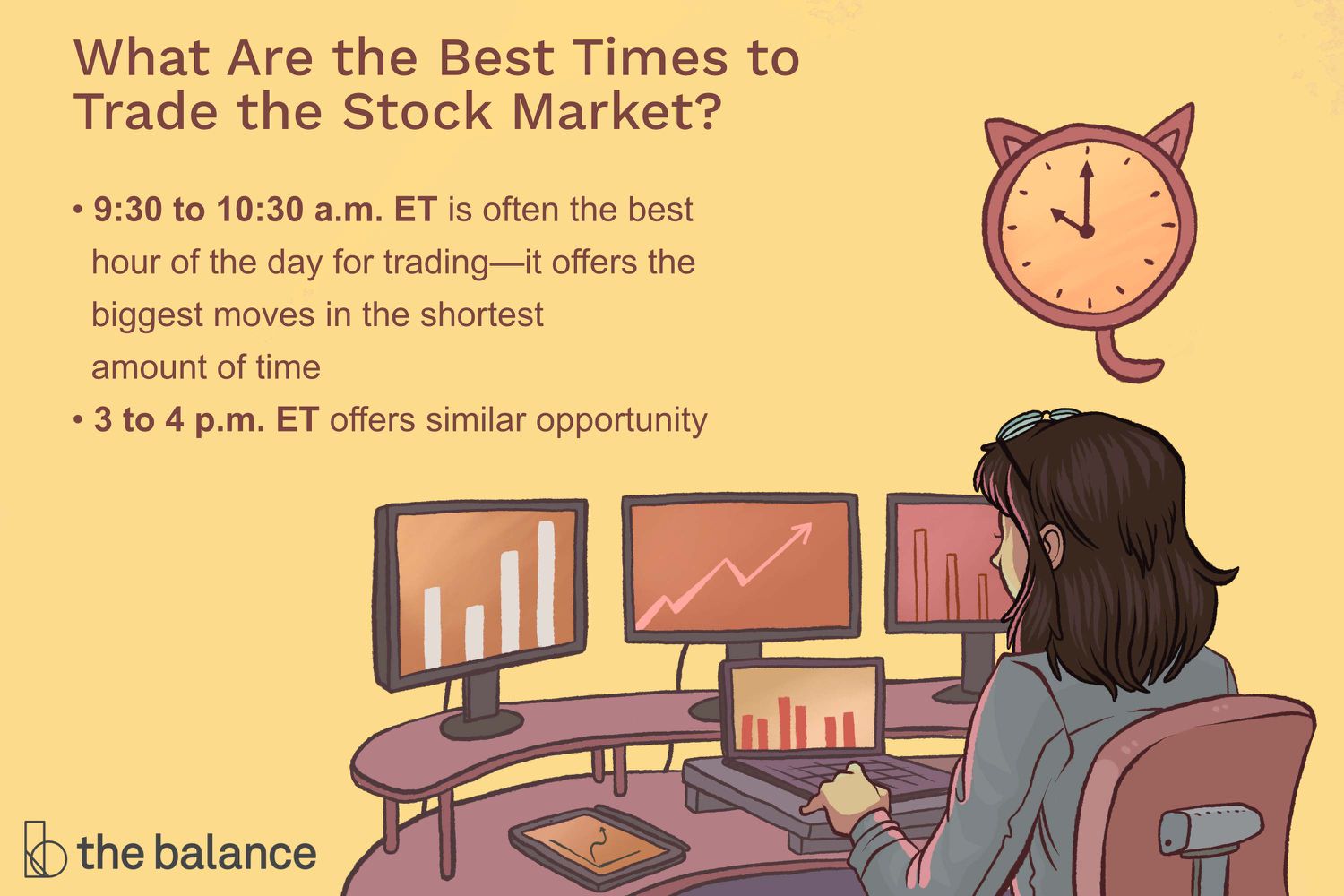

The best times to day trade the stock market may be the first two hours of the day. In the US, this is from the time the market opens at 9:30 am to 11:30 am EST. Another good time to day trade may be the last hour of the day. In the US, that is from 3 pm to 4 pm EST.

note

Take the time to understand the hours of the stock market you plan to trade on so you can be sure you’re trading during the most optimal times.

Trading When the Market Opens

Trading during the first one to two hours that the stock market is open on any day is all that many traders need. The first hour tends to be the most volatile, providing the most opportunity (and potentially the most risk). Although it sounds harsh, professional traders often know that a lot of “dumb money” is flowing at that time.

So-called dumb money is the phenomenon of people making transactions based on what they read in the news or saw on TV the night before. The information these people are acting upon is typically old news. Their trades can create sharp price movements in one direction. Then professional traders take advantage of the extremely high or low price and push it back the other way.

New day traders are often told not to trade during the first 15 minutes of the day—and that might be good advice for very new traders—but the first 15 minutes typically offer the best opportunities for seasoned traders. That time period can provide the day’s biggest trades on the initial trends.

Best Trading Time of the Day

Regular trading begins at 9:30 am EST, so the hour ending at 10:30 am EST is often the best trading time of the day. It offers the biggest moves in the shortest amount of time.

Many professional day traders stop trading around 11:30 am, because that’s when volatility and volume tend to taper off. Trades take longer, and moves are smaller on lower volume—not a good combination for day trading.

Futures trade virtually 24 hours per day during the weekday, so if you’re day trading index futures such as the E-mini S&P 500 (ES) or an index-based ETF like the SPDR S&P 500 (SPY), you might begin trading as early as 8 am during pre-market hours and begin tapering off at around 10:30 am That provides a solid two hours of trading, usually with a lot of profit potential.

note

As with stocks, trading can continue up to and beyond 11:30 am EST, but only if the market is still providing opportunities to capitalize on the trading strategies you’re using.

Trading During the Last Hour

Many day traders also trade the last hour of the day, from 3 to 4 pm EST. By that time, traders had a long break since the morning session, allowing them to regroup and regain their focus.

The last hour can be a lot like the first when you’re looking at common intraday stock market patterns. It’s full of bigger moves and sharp reversals. Like the first hour, many amateur traders jump in during the last hour, buying or selling based on what has happened so far that day. Dumb money is once again floating around, although not as much as there was in the morning. It’s ready to be scooped up by more experienced money managers and day traders.

note

The last several minutes of trading can be particularly active, with big moves on high volume.

Best Days and Months to Trade the Stock Market

Keep the bigger picture in mind, too, beyond the hourly grind. Monday afternoon is usually a good time to buy, because the market historically tends to drop at the beginning of the week, particularly around the middle of the month. Many experts recommend selling on Friday before the Monday dip occurs, particularly if that Friday is the first day of a new month or when it precedes a three-day weekend.

Likewise, prices tend to drop in September and then hike again a month later. October is generally positive overall, and prices often go up again in January, particularly for value and small-cap stocks.

The Bottom Line

Day trading requires discipline and focus, both of which are like muscles. Overwork them, and the muscles give out. Trading only two to three hours a day may keep you on your game, and it likely won’t lead to the mental fatigue that can negatively affect your work. Trying to trade six or seven hours a day can drain you and make you more susceptible to mistakes.

Of course, everyone has different focus and discipline levels. Some traders might be able to buy and sell all day and do it well, but most do better by trading only during the few hours that are best for day trading.

Day trading is not for everyone, and there are many rules and risks involved. Be sure to understand how to day trade and practice before you start trading real money to determine whether it’s really right for you.

Frequently Asked Questions (FAQs)

What time does after-hours stock trading close?

What happens if I place a market order for stocks after hours?

Depending on your brokerage, you may be able to successfully place an after-hours market order (assuming someone is willing to sell). However, the after-hours market has less trading volume, and this affects liquidity and price action. Limit orders help you control these unexpected price movements, and some brokerages may force traders to place limit orders during after-hours trading.

What are stock market hours in Pacific Time?

For those on the West Coast of the United States, stock market hours are from 6:30 am PST through 1 pm

What hours is the Japanese stock market open?

The Tokyo Stock Exchange is open from 9 am through 3 pm local time with an hour break for lunch at 11:30. Tokyo’s time zone is ahead of the US, so that’s 7 pm (of the previous day) to 1 am EST.