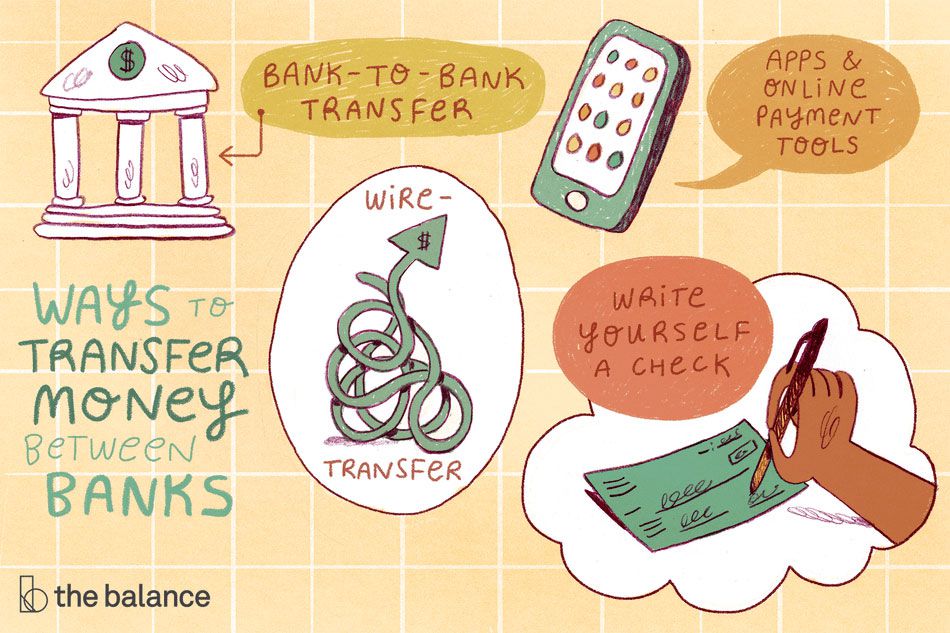

Online banking makes transferring money between bank accounts easier than ever. You can move money from one bank to another electronically using a variety of tools. Each method has pros and cons, but they all get the job done.

Bank-to-Bank Transfer

If you’re an owner of both bank accounts, a basic bank-to-bank transfer is a good option. You can set up the transfer with the sending or receiving bank, and the funds arrive at the destination after two or three business days. The timing ultimately depends on which banks you use and whether you are moving money internationally or domestically.

Many banks allow you to make free transfers between connected accounts, but it’s a good idea to check with both banks, just to be safe.

note

Before you can complete a transfer, you need to link your accounts. That process can take about a week, so be sure to establish the link before you need to send money.

How to link your accounts:

- Log in to the account you plan to send money from, and look for an option to “add an account,” “add external accounts,” or “link accounts.” You might find those options (or something similar) in your bank’s Customer Service or Transfers menu.

- Provide the other bank’s routing number and your account number at that bank. If you don’t have that information, get those numbers from a check, from that account’s online banking account, or from a representative at your bank.

- After submitting that information, you may need to verify that you own the external account. You typically do this by providing a username and password for that account or by confirming small “test” transfers between the two banks.

This method is easiest if both bank accounts are in your name. To transfer funds to someone else, you may need to use a third-party payment provider (such as PayPal) or a wire transfer. Ask your bank what the best solution is.

External Transfer Fees

As online banking has gained in popularity, fees for sending money to external accounts have become less common. Many popular banking institutions offer the service for minimal charges or free if you meet certain criteria. Here’s a small sampling of those institutions:

- Capital One 360

- Chase

- Citi

- Discover Bank

- Navy Federal Credit Union

- PNC Bank

- Synchrony Bank

- Wells Fargo

This is not an exhaustive list, as many credit unions and banks also offer similar services for free. Check with local institutions for details.

Apps and Online Payment Tools

If your bank doesn’t offer bank-to-bank transfers or if you need to send money to someone else, person-to-person (P2P) payment tools may provide what you need. To set up your accounts, link your bank account to the app or service using your checking account and routing numbers the same way you link accounts from separate banks. For example, if using PayPal, the funds you send come out of your bank account. PayPal then moves funds to the recipient’s PayPal account, and the recipient then can spend the money via PayPal or transfer it to a bank account.

Numerous options are available:

- PayPal is one of the most popular services. It may be the easiest to use since its popularity means both senders and recipients are likely to have active PayPal accounts. There is no charge to transfer money to friends and family if you fund the payment from your bank account. But funding transfers with a debit card, credit card, or PayPal credit may result in fees. Businesses may also have to pay PayPal to receive payments from customers.

- Most banks offer free or inexpensive P2P transfers through Zelle, Popmoney, or similar vendors. Those services are often added to your checking account automatically. Look for “personal payments,” or something similar, while you’re logged in to your account.

- Venmo is a popular tool owned by (and similar to) PayPal. Transfers into a Venmo are free unless you’re using the “cash a check feature,” and transfers out are free unless you’re using a credit card (a 3% charge).

- Google Pay is similar to the services above, and you can link it to (or use it to pay for) Google products and services.

Writing Old-Fashioned Checks

Not in any rush to move the money? Sometimes technology is more trouble than it’s worth. Maybe you’ve got a few bucks sitting around in an old bank account, and you just want to move that cash to your new bank. It might not be worth the effort to punch in all the routing and account numbers and sign up for a new app just for that.

If you’ve got checks, writing one to yourself is a simple solution. Just enter your own name down as the payee, and deposit the check into your new account. You can take care of the whole thing without leaving the house if you deposit the check with your mobile device.

If you don’t have a check, ask your bank to print one for you. Even if you’re nowhere near a bank branch, there’s rarely any difficulty getting a check made payable to you (the account owner) and mailed to your home address on file with the bank.

If you use a credit union that’s part of the shared branching network, you can walk into almost any participating branch in the country and request a check. Moving funds from one credit union to another might be especially easy—and something you can complete in one trip—if they’re both part of the network.

Frequently Asked Questions (FAQs)

How long does it take to transfer money from PayPal to a bank account?

Transfers from PayPal to a bank account can settle within one day or they can take up to three days. You can also pay a fee for an instant transfer that settles within 30 minutes.

How do you transfer an IRA to another bank?

IRA funds cannot be transferred from one bank to another as easily as cash from a checking account. You must open a rollover IRA account and arrange for an IRA rollover from your current account. Failure to properly transfer IRA funds could result in penalty taxes.